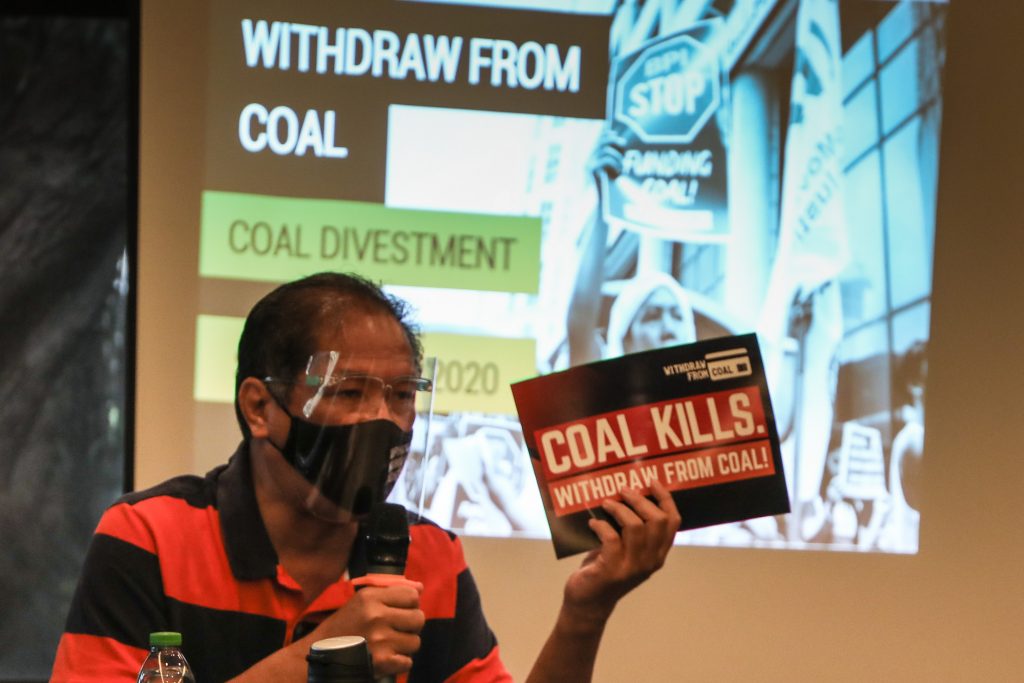

A group of activists belonging to the Withdraw From Coal Coalition released a list of what they described as the “dirtiest” financial institutions in the country.

The banks on the list allegedly invested at least US$13.42 billion on “dirty energy” projects, including coal-fired power plants and in coal companies from 2009 to 2019.

The Center for Energy, Ecology, and Development (CEED), used a “scorecard” to evaluate the financing activities of banks in the coal industry.

Among the criteria used in the “scorecard” was “coal exposure,” or the amount of investment that a bank provided to fund coal projects.

The activists listed the Bank of Philippine Islands on top of the list with the biggest coal exposure at about US$3.48 billion in over 28 deals with a total value of US$13.2 billion.

Gerry Arances, executive director of CEED, said BPI was key to the financing of at least 15 coal plant projects and six coal developer companies with deals maturing up to December 2030.

Next on the list is BDO Unibank and the Philippine National Bank that issued about US$2.52 billion and US$ 1.60 billion in loans and underwriting, respectively.

Other banks mentioned in the list were Bank of Commerce, China Banking Corporation, Development Bank of the Philippines, East West Banking Corporation, Land Bank of the Philippines, Metropolitan Bank & Trust Company, Philippine Bank of Communication, Rizal Commercial Banking, Security Bank, Union Bank of the Philippines, and United Coconut Planters Bank.

The scorecard also includes the banks’ “divestment policy grade” that assesses the institutions’ “commitments or pronouncements or adopted policies and practices towards divestment” from dirty energy projects.

Arances said all 15 banks got “low scores for divestment.” He said most of the banks had “zero score” because they have yet to adopt a “sort of business policy to exclude, phaseout, restrict, or even reduce financing for coal-related projects or companies.”

BPI, DBP, and RCBC received positive scores because of their pronouncements that they will no longer fund coal projects.

The Withdraw From Coal Coalition also gave the banks a grade for their efforts to contribute to address “climate emergency.”

DBP and RCBC were declared top performing banks because their current business engagements already incorporate “potential environmental and social impacts.”

Bishop Gerardo Alminaza of San Carlos, co-convener of the coalition, called on banks and financial institutions “to phase out” their activities that enable the expansion of coal use in the country.

“If they will not choose to phase out these activities, our future and that of generations to come, are placed in greater peril,” said the prelate.

There are at least 29 coal plants currently operating across the country and more than 20 projects that are still in the pipeline.

Bishop Alminaza said they hope that through the “scorecard,” civil society groups can assist banks in reevaluating their responsibilities in the climate sphere.

On Oct. 27, 2020, the country’s Energy department announced that it will no longer be endorsing any new greenfield coal-fired power plant projects.

The department, however, is yet to release a written order detailing the scope of the moratorium.

Katrin Ganswindt of the German research organization Urgewald said “ditching new coal [projects] is only the first step.”

“What is needed next from the Philippine banks is a coal exit plan for their financing, using transparent criteria for a continuous coal phase-out ending no later than 2040,” she said.

Source: Licas Philippines

0 Comments